If you’ve been holding off on buying a home, hoping mortgage rates will drop significantly, you’re not alone. Many buyers are in the same boat, waiting for a big shift before making a move. But will that actually happen?

What Experts Predict for Mortgage Rates

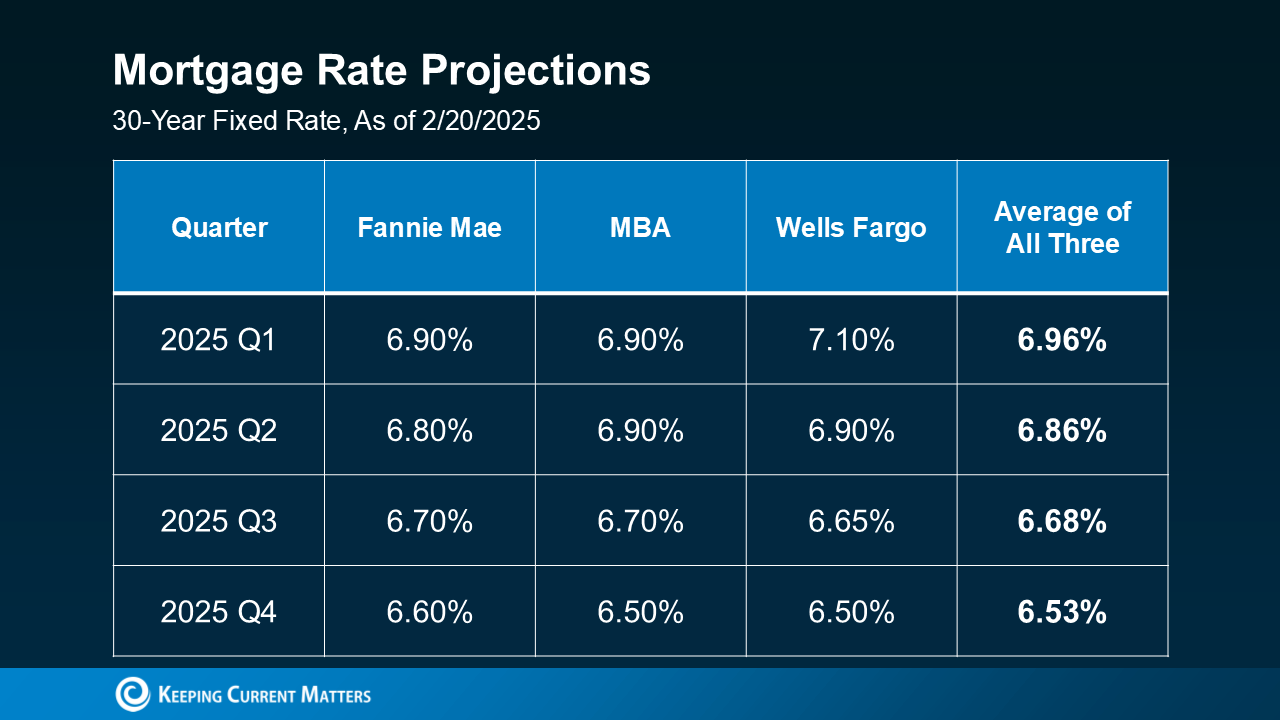

Earlier this year, some forecasts suggested rates could dip below 6% by the end of the year. However, recent projections from Fannie Mae, the Mortgage Bankers Association (MBA), and Wells Fargo indicate that rates will likely stabilize closer to 6.5% instead.

That means if you’re waiting for a major rate drop, you could be waiting a while. And if you need to move because of a job change, a growing family, or another life event, delaying your homeownership plans may not be the best choice.

The good news? You don’t have to wait to make homeownership more affordable! There are smart financing strategies that can help you buy now, even with today’s rates.

3 Smart Financing Strategies To Buy a Home Now

💡 1. Mortgage Buydowns

A mortgage buydown allows you to lower your mortgage rate temporarily by paying an upfront fee. Sellers can also offer this as a concession to attract buyers. According to recent agent reports, 27% of first-time buyers are requesting buydowns to make their monthly payments more manageable.

💡 2. Adjustable-Rate Mortgages (ARMs)

ARMs start with a lower interest rate than traditional 30-year fixed mortgages, making them a great option if you expect to refinance in the future. And if you’re concerned about the risks of ARMs, today’s versions are much different from the risky loans of the early 2000s. Now, lenders thoroughly verify buyers’ ability to pay even after rates adjust, reducing financial risk.

💡 3. Assumable Mortgages

An assumable mortgage allows you to take over the seller’s existing home loan—including their lower interest rate. Over 11 million homes qualify for this option, making it a smart strategy to explore if you want to secure a more affordable rate.

Bottom Line

If you’re holding off on buying a home because you’re waiting for a big drop in mortgage rates, you may be waiting longer than expected. Instead of delaying your plans, consider creative financing solutions that can help you secure a home now—on your terms.