Exploring the realm of home affordability unveils a complex interplay of three fundamental factors: mortgage rates, home prices, and wages. While discussions around housing affordability have intensified, recent shifts offer promising insights, particularly in mortgage rates.

1. Mortgage Rates

In recent months, mortgage rates have experienced a downward trajectory, with further declines anticipated in the coming year. This trend, as highlighted by Jiayi Xu, an economist at Realtor.com, holds significant implications for buyers, enhancing purchasing power through reduced monthly mortgage payments.

2. Home Prices

Despite projections of modest inventory growth, home prices are expected to rise steadily in 2024. Lisa Sturtevant, Chief Economist at Bright MLS, notes that while prices are on an upward trajectory, they are unlikely to skyrocket as seen during the pandemic. However, waiting may incur higher costs as market demand increases and prices continue to climb.

3. Wages

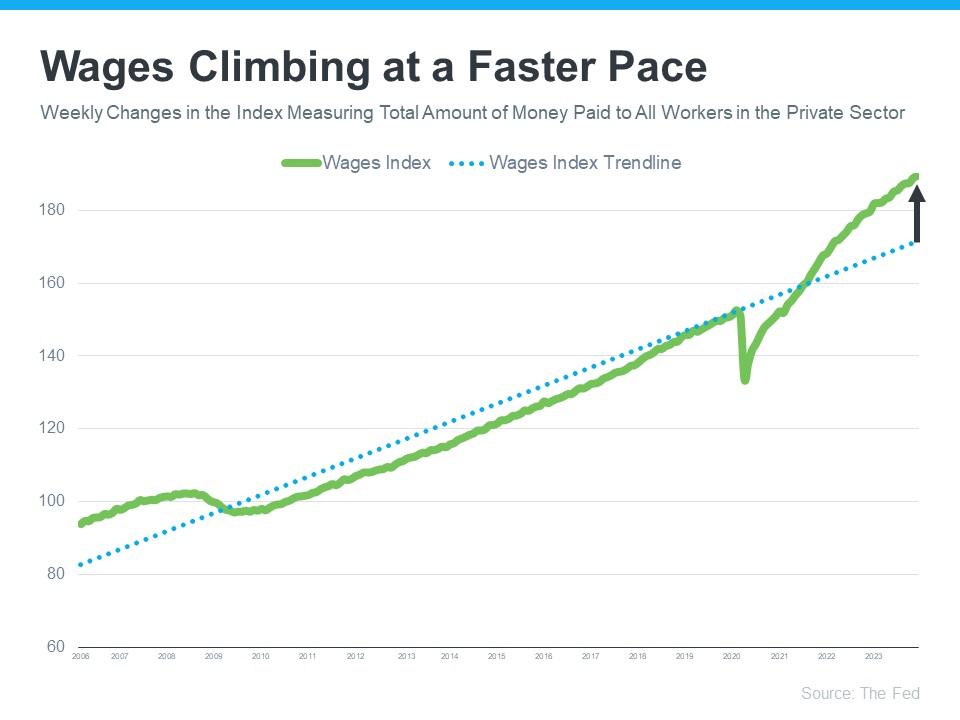

A positive aspect contributing to affordability is the upward trend in wages. Current data from the Federal Reserve indicates that wages are exceeding typical growth rates, thereby alleviating the burden of mortgage payments for buyers.

What Does This Mean for Buyers?

The convergence of declining mortgage rates, steady home price growth, and rising wages presents a favorable landscape for prospective buyers, enhancing overall affordability.

In Conclusion:

For those considering a home purchase, understanding the dynamics of affordability is crucial. The positive trends in mortgage rates, coupled with moderate price growth and rising wages, signify an opportune moment for buyers. Stay informed and connected with trusted real estate agents for the latest insights and guidance in navigating the housing market.